The Affordable Bankruptcy Lawyer Tulsa Diaries

Not known Facts About Bankruptcy Law Firm Tulsa Ok

Table of ContentsWhat Does Tulsa Debt Relief Attorney Do?Affordable Bankruptcy Lawyer Tulsa - An OverviewTop-rated Bankruptcy Attorney Tulsa Ok Can Be Fun For AnyoneExperienced Bankruptcy Lawyer Tulsa Fundamentals ExplainedExamine This Report on Tulsa Ok Bankruptcy Attorney

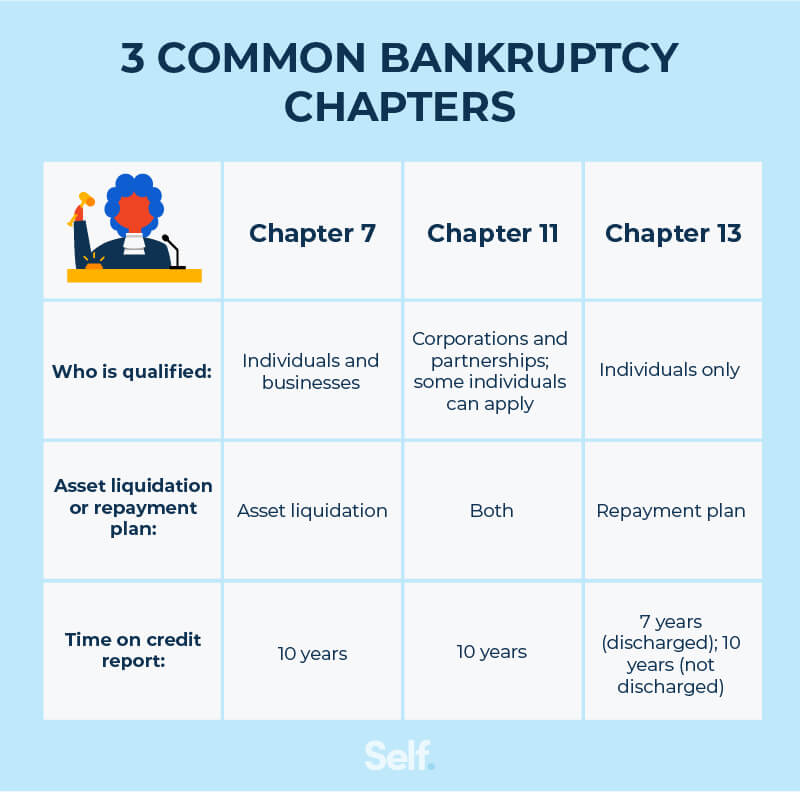

The statistics for the various other major kind, Chapter 13, are even worse for pro se filers. (We damage down the distinctions between both key ins deepness below.) Suffice it to say, speak to a lawyer or two near you that's experienced with insolvency law. Right here are a few sources to discover them: It's reasonable that you could be reluctant to spend for an attorney when you're currently under significant financial pressure.Many attorneys also supply free consultations or email Q&A s. Take advantage of that. (The charitable app Upsolve can aid you locate cost-free appointments, sources and lawful aid for free.) Ask them if bankruptcy is indeed the appropriate option for your circumstance and whether they think you'll qualify. Before you pay to file insolvency types and blemish your credit report for up to ten years, check to see if you have any feasible alternatives like debt settlement or non-profit credit rating counseling.

Ads by Cash. We may be compensated if you click this ad. Advertisement Now that you have actually determined personal bankruptcy is certainly the appropriate course of action and you with any luck cleared it with a lawyer you'll need to start on the paperwork. Before you dive into all the main personal bankruptcy kinds, you ought to get your own files in order.

Excitement About Tulsa Debt Relief Attorney

Later on down the line, you'll really need to show that by divulging all type of info regarding your economic events. Below's a fundamental list of what you'll need when traveling ahead: Identifying files like your vehicle driver's certificate and Social Safety card Tax returns (as much as the past four years) Proof of income (pay stubs, W-2s, freelance incomes, income from assets along with any earnings from federal government advantages) Bank declarations and/or pension statements Evidence of worth of your properties, such as vehicle and property evaluation.

You'll desire to comprehend what type of debt you're trying to fix.

You'll desire to comprehend what type of debt you're trying to fix.If Tulsa bankruptcy attorney your earnings is too expensive, you have one more option: Phase 13. This choice takes longer to solve your debts since it needs a lasting payment strategy generally three to five years before several of your staying financial obligations are wiped away. The declaring process is additionally a whole lot more complicated than Chapter 7.

Little Known Questions About Chapter 13 Bankruptcy Lawyer Tulsa.

A Phase 7 insolvency remains read the full info here on your credit score report for 10 years, whereas a Chapter 13 insolvency falls off after seven. Both have long lasting influence on your credit report score, and any new financial obligation you secure will likely feature greater rate of interest. Prior to you submit your personal bankruptcy kinds, you have to first complete an obligatory course from a credit counseling agency that has been authorized by the Division of Justice (with the noteworthy exemption of filers in Alabama or North Carolina).

The course can be completed online, in person or over the phone. Courses generally cost in between $15 and $50. You need to complete the course within 180 days of declaring for bankruptcy (bankruptcy lawyer Tulsa). Make use of the Division of Justice's website to find a program. If you live in Alabama or North Carolina, you have to select and complete a course from a checklist of independently accepted companies in your state.

Some Known Details About Tulsa Ok Bankruptcy Attorney

Check that you're filing with the appropriate one based on where you live. If your long-term house has relocated within 180 days of filling up, you must file in the area where you lived the higher section of that 180-day duration.

Usually, your bankruptcy lawyer will certainly work with the trustee, yet you may require to send out the individual files such as pay stubs, tax obligation returns, and financial institution account and credit card statements straight. A common mistaken belief with personal bankruptcy is that as soon as you file, you can quit paying your financial obligations. While bankruptcy can aid you wipe out numerous of your unprotected debts, such as past due medical costs or individual financings, you'll want to keep paying your regular monthly repayments for safe debts if you want to keep the building.

6 Simple Techniques For Top-rated Bankruptcy Attorney Tulsa Ok

If you're at risk of repossession and have worn down all other financial-relief alternatives, then filing for Phase 13 may delay the foreclosure and conserve your home. Ultimately, you will still need the income to proceed making future mortgage settlements, along with paying off any late settlements throughout your payment strategy.

If so, you might be required to give extra information. The audit can delay any kind of financial debt alleviation by numerous weeks. Naturally, if the audit shows up incorrect information, your situation can be disregarded. All that stated, these are rather unusual instances. That you made it this much while doing so is a decent indication a minimum of some of your debts are qualified for discharge.